Home > What A Rich Nation Should Really Be Doing About Social Security

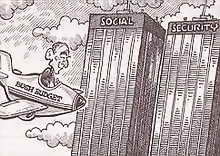

What A Rich Nation Should Really Be Doing About Social Security

by Open-Publishing - Tuesday 1 March 20054 comments

Edito Healthcare Governments USA

by Gar Alperovitz

Listening to the debate between the Administration and even its most adventurous critics one would imagine that only an extremely limited range of Social Security options are even conceivable. One would also imagine that we live in an extremely poor society which is ultimately going to have to find ways to squeeze its seniors financially or somehow we will all perish. The truth is radically different.

This is the wealthiest nation in the history of the world. A serious progressive strategy should go far beyond the current debate by building upon this self-evident fact. It should affirm the goal of a truly bountiful-rather than penny-pinching-future for its citizens when they retire. Here is the ball to keep your eye on.

If the United States does merely as well in the 21st Century as it did during the difficult depression and war-dominated 20th Century, we Americans will be producing the equivalent of approximately $1 million a year for every four people by century’s end-and the top 1% of households will be making an estimated $9-10 million. Clearly, if we so choose, we can afford a very, very generous plan.

Oddly so far just about the only people who seem to recognize the obvious reality that a rich nation will be able to afford more rather than less as technological progress continues are a couple of maverick (but very high placed!) conservatives. Thus:

The Nobel prize-winning conservative economist Robert Fogel has offered a comprehensive life-time savings and investment plan which would start retirement at age 55. Unlike proposals by both liberals and other conservatives which would delay retirement and make people work longer in order to save money for the Social Security system, a major goal is to allow people to retire at a younger and younger age as the nation’s wealth increases over the century. A tax of 2 or 3 percent “applied progressively to the top half of the income distribution” would aide those with low incomes.

Another leading conservative maverick, former Bush Treasury Secretary Paul O’Neil has put forward a savings and investment plan which would produce the equivalent of a million dollar annuity for every American-enough to easily guarantee $50,000 or more a year. It would begin with those currently in the 18-35 age bracket and would be supplemented by federal contributions for low income people. Like Fogel, O’Neil argues: “Those of us who are more fortunate can help those who are not.”

Several progressives have suggested equity-increasing approaches which might usefully be combined with the basic Fogel and O’Neil concept. Hofstra University School of Law professor Leon Friedman, for instance, has proposed an annual one percent “net worth tax” on the top 1% of households in order to provide full Social Security financing-and to also help reduce the national debt. Such “wealth taxes” are common in virtually every other advanced industrial and post-industrial society.

A comprehensive plan by Colgate University economist Thomas Michl would ultimately establish a fully funded investment based system (as opposed to the current “pay-as-you-go” Social Security design). This would include a broad range of stocks and bonds and would be financed by progressive income taxes and also by a new wealth tax.

A plan by New School University sociologist Robin Blackburn would (1) expand Social Security; (2) pool private pension plans in order to reduce risk; and (3) institute a “share levy”— an implicit wealth-like tax which would require firms to issue and set-aside stock equivalent to10-20% of profits each year in order to increase pension fund capital.

A very general proposal to invest Social Security reserves which builds on current state pension fund precedents-and the Canadian national system-has been offered by Boston College management professor Alice H. Munnell and Brookings fellow R. Kent Weaver. Importantly, as they observe, public management of such plans is hardly “financial rocket science...”

It’s worth recalling, too, that the Roosevelt Administration’s Social Security program was originally based on a cautious investment approach-later abandoned because Keynsian economists worried it was draining purchasing power from the 1930s economy. The Clinton Administration also proposed a modestly progressive investment strategy of up to 14.6% of the Social Security Trust Fund.

What is striking is that such precedents and the bolder proposals on both right and left all agree, first, that a rich country can afford more rather than less for its seniors as time goes on; second, that taxing those at the very top for this purpose is obvious and appropriate; and third that one or another form of investing makes sense financially if done under public authority.

Even the most adventurous Democrats are currently mainly huddled in a defensive posture as they try to resist the onslaught of the Bush challenge. Yes, a defense against the Bush strategy is necessary. But No, it is not enough: What the right realized years ago is that the way forward is to begin laying bold proposals on the table. The question is how long it will take be before progressive politicians start doing the same.

Gar Alperovitz is Lionel R. Bauman Professor of Political Economy at the University of Maryland. This article is adapted from his recent book ’America Beyond Capitalism: Reclaiming Our Wealth, Our Liberty and Our Democracy’ (Wiley 2005).

Forum posts

2 March 2005, 06:59

I have seen incredible poverty in America. Rich nation? For whome?

2 March 2005, 07:01

I have seen incredible poverty in America. Rich Nation? Who? 1 % of the citizen own 90 % of the

country! Sounds familiar?

2 March 2005, 17:01

bush is plundering social security to line his own pocket.forty percent of the people where i live are not working.that is not a sign of wealth.

2 March 2005, 23:29

With Robin Blackburn’s concept and also to a lesser extent, the Canadian idea of investment funds, US workers, throught their Social Security would end up more or less owning the economy. No need for the capitalists then. I think I see why Bush is trying to plunder the SS and also why it wasn’t set up that way in the first place...